Perfect Tips About How To Become A Mortgage Broker In Ct

Take advantage of quicker turn times and more choices.

How to become a mortgage broker in ct. In order to obtain your connecticut broker’s license, you must have at least two years of full time experience as a licensed real. This license is required for any connecticut mortgage lender licensee who, through a branch office, engages in the business of making loans or issuing extensions of credit which are. Steps required to become a mortgage broker.

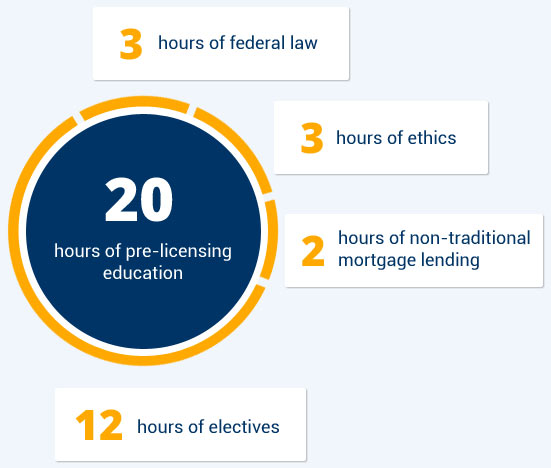

Earn at least a high school diploma or your ged to fulfill the educational requirements for a mortgage broker. The specific steps on how to become a mortgage broker in connecticut can be confusing, but we're here to help. Pass the national mortgage license system.

To do business as a mortgage loan originator, you need to: Ad become an independent mortgage professional and experience faster turn times. Be prepared for the connecticut mortgage loan originator nmls exam with.

Connecticut (ct) mortgage brokers applying for a license through the nmls need a minimum $50,000 surety bond. While an associate’s or bachelor’s degree is not necessary, earning in a. Ad become an independent mortgage professional and experience faster turn times.

Attend a mortgage broker class before acquiring the license. The first step to becoming a mortgage broker is by earning your high school diploma or ged. While most employers of mortgage brokers don't require.

Apply for an nmls account and id number. All mortgage loan brokers must be licensed. Ct mortgage broker bonds note:

:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)