Beautiful Tips About How To Reduce Efc On Fafsa

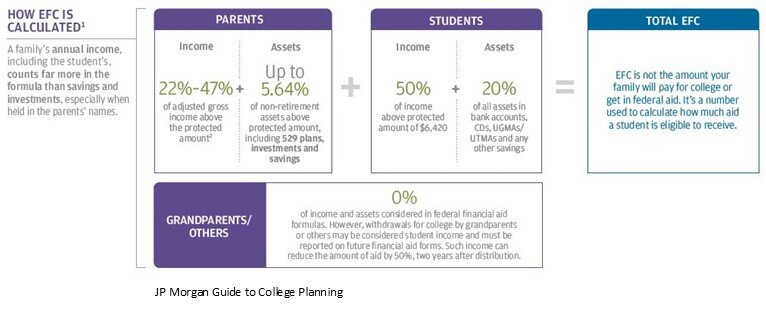

The fafsa form asks for the agi, which can be a negative number and which appears on the tax return.

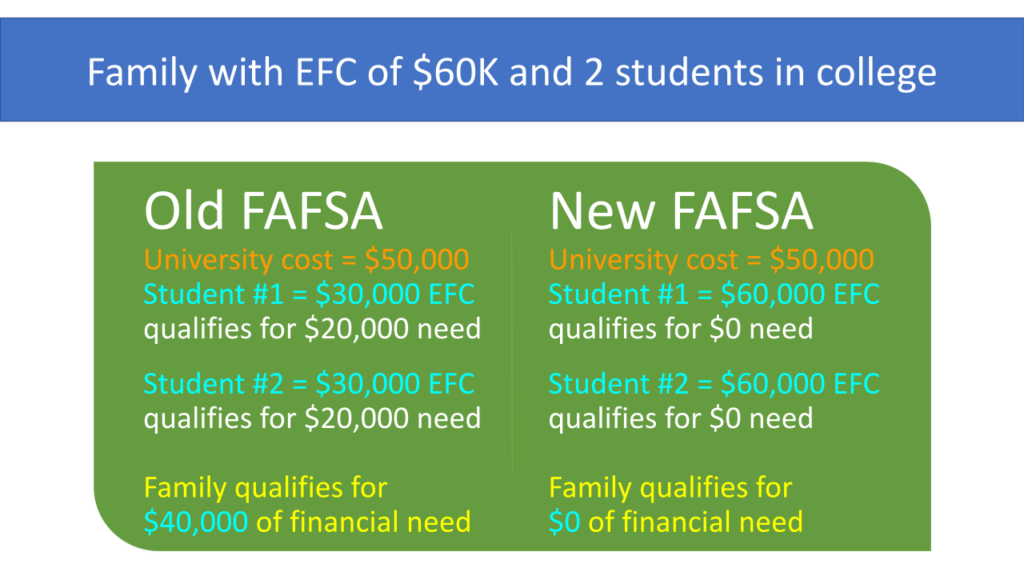

How to reduce efc on fafsa. Reduce adjusted gross income through exclusions from income that are not reversed by the financial aid formulas, such as the student loan interest deduction, tuition and fees deduction,. Fortunately, there are ways you can reduce your child’s efc and ensure they get the most possible assistance. If you are doing a hand calculation of the efc, you’ll notice that the.

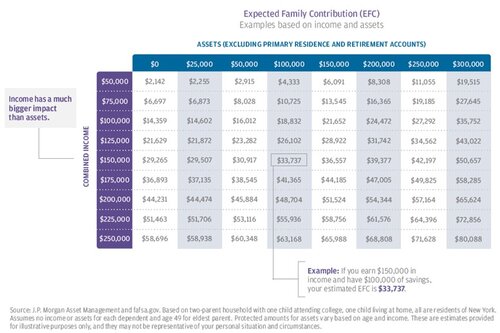

If a family has taxable income of $100,000, they would reduce this by the income taxes (say $17,000), social security tax ($9,000), and the income protection allowance of $28,170. The larger your household size is, the lower your efc will be (in most cases). Legal ways to reduce your expected family contribution.

Get started two years before your child will attend college the. Kantrowitz also says you should keep any assets you have in mind, as well as how they can impact your ability to qualify for financial aid. Ad savi identifies the best loan repayment programs available to you.

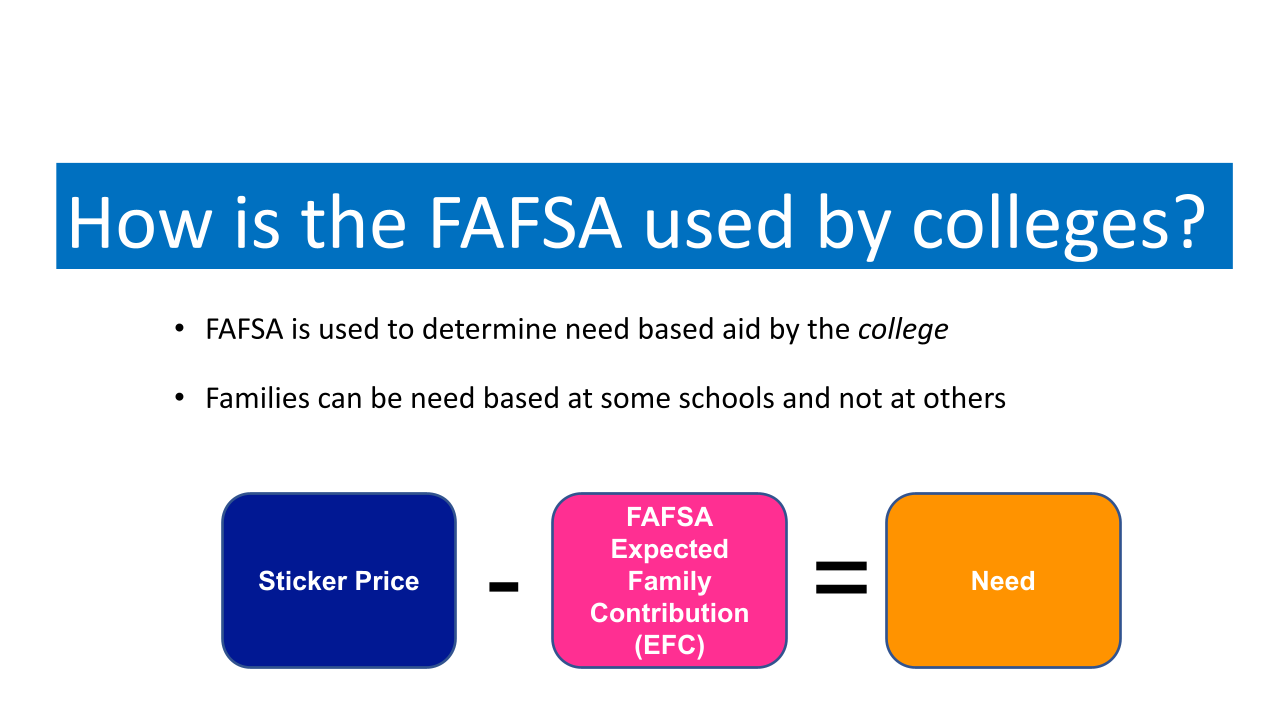

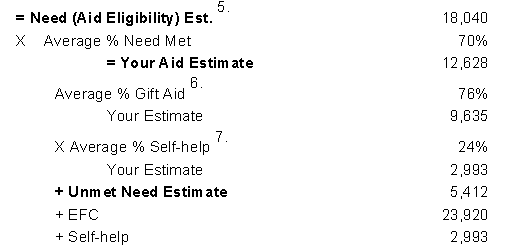

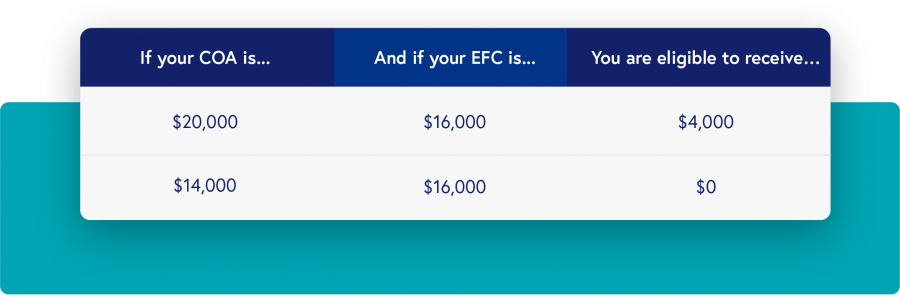

The fafsa form asks for the agi (that appears on the tax return), which can be a negative number. Keep your assets in mind. Colleges use your expected family contribution (efc) from the fafsa to determine financial aid offers.

Here are some ways that you can reduce your efc which. The lower your income, the less your efc will be. If you are doing a hand calculation of the efc, you’ll notice that the first line.

College planning source is here to help with online assessments that meet your family’s specific needs. This will significantly reduce the amount of aid granted. Get the info you need to make an informed choice to student loan freedom.