Looking Good Tips About How To Get A Sales Tax Number

Business tax online registration system.

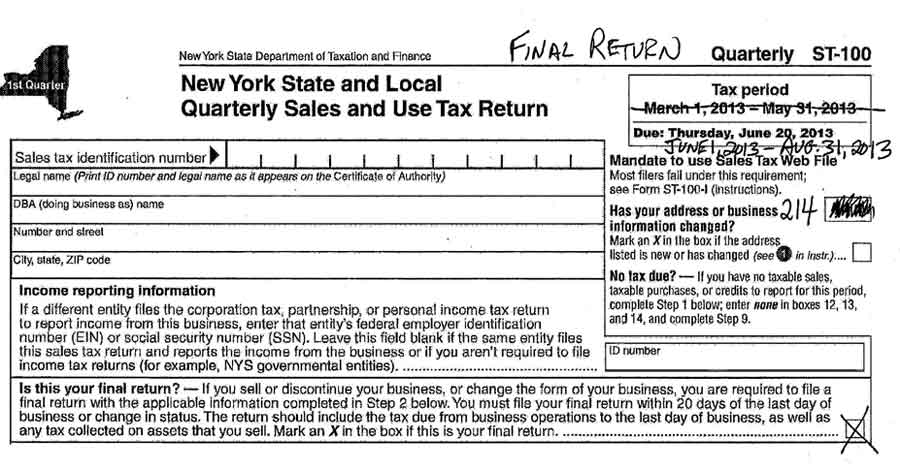

How to get a sales tax number. Register for a free taxpayer access point (tap) account to file and pay sales tax 24/7. Sales and use tax laws. You can fill out a sales tax number or ein number application online, on our website.

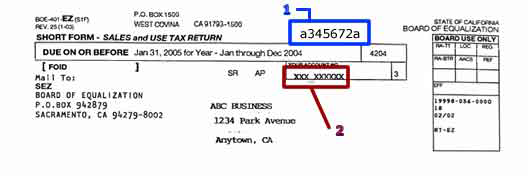

After your online submission, you should receive your specific tax account number within 15 minutes by email. By statute, the 6% sales and use tax is imposed on a bracketed basis. The amount of tax due is determined by the sale price in relation to the statutorily imposed brackets.

Determine whether your business is eligible for a tax exempt card. To apply, please go to tennessee taxpayer access point (tntap) and select. Ensure we have your latest address on file.

Registration of sales tax is available on the tennessee taxpayer access point (tntap). References and other useful information. The following is what you will need to use telefile for sales/use tax:

Check on the status of your individual income refund. Tap.utah.gov choose “apply for a tax. There are no local sales and use taxes in kentucky.

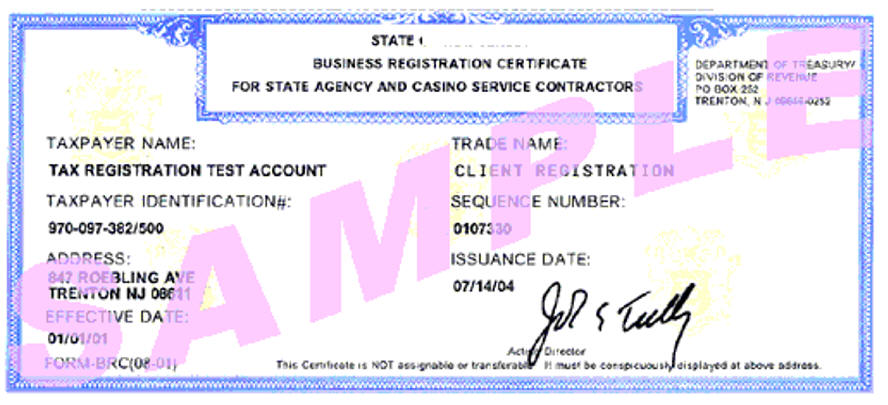

A packet containing your permit and information. Go to tap and follow instructions for online registration. The registration with fbr provides you with a sales tax registration.